How Trump’s Tariffs Affect the Anime & Manga Industry

The trade war is coming for U.S. anime fans.

While many industries panic in response to Trump’s tariffs, the anime and manga industries both in Japan and in the U.S. sit in an interesting place. While there’s some cause for concern, other parts of the industry are more shielded. Here’s what we know so far.

But first….

- Miles A.

Chart of the Week

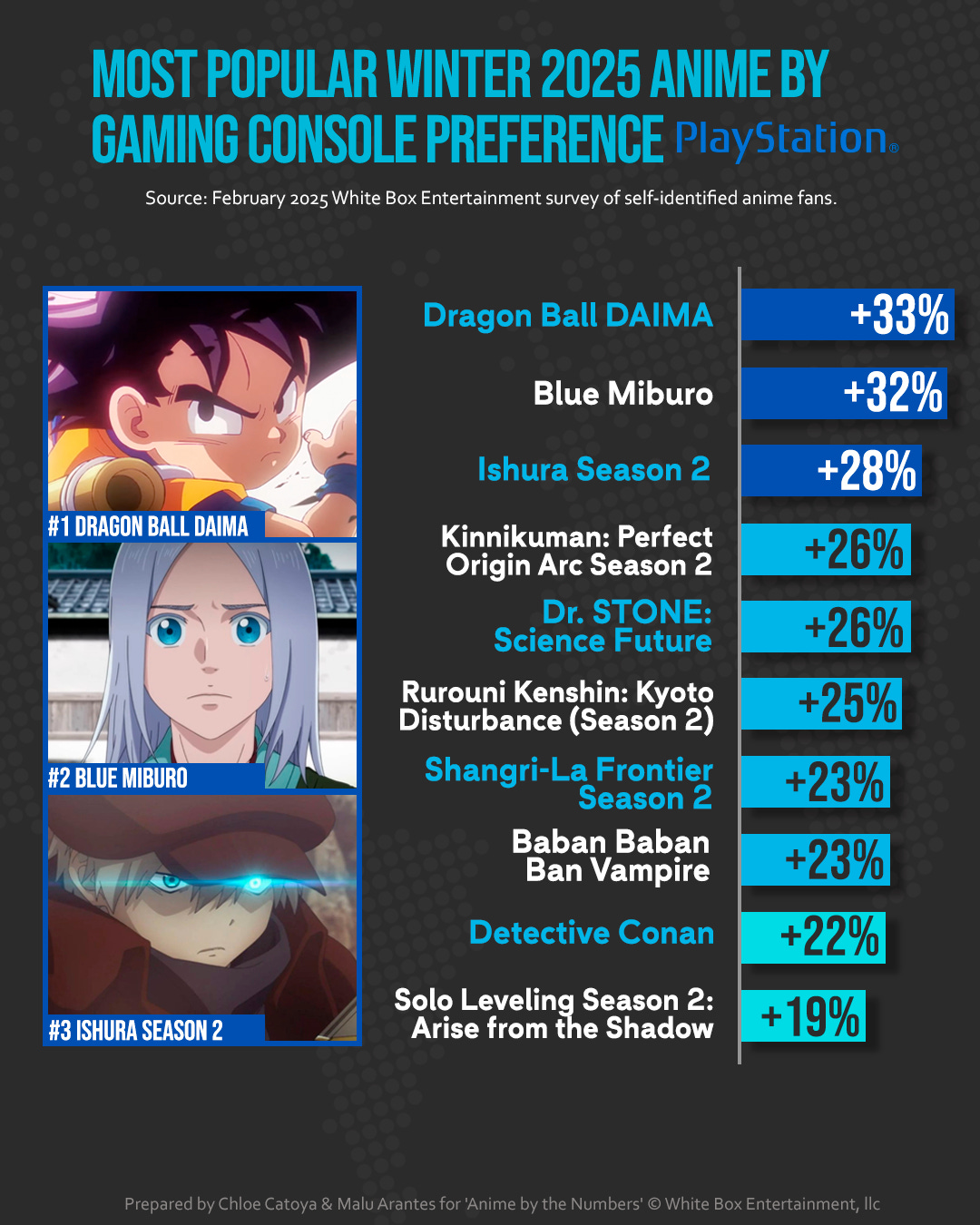

Anime and gaming, while often represented as symbiotic hobbies, do not translate to monolithic consumer behaviors. Our survey data shows clearly defined taste differences amongst self-identified anime fans, depending on their preferred gaming console.

Xbox users over-index by a wide margin watching isekai titles, while action titles perform best with Playstation users. Nintendo gamers over-index watching titles with higher female viewership.

Notably, XBox gamers have the strongest in-group trends. The title that they are more likely to watch than any other title (I’m Living With An Otaku NEET Kunoichi?!) is over 2x times more likely to be watched by that user base than either of the top titles for Playstation and Nintendo gamers were for their respective audiences. - Chloe C.

Entertainment At Large

What Working on Princess Mononoke at Studio Ghibli Taught Me (Vulture)

As Princess Mononoke’s 4k remaster is released in theaters, this lovely piece about French animator David Encinas’ journey to working on the film gives great insight into the history of cultural exchange behind anime. From speaking through a translator to Miyazaki to surviving the crunch, it’s an essential read. (Encinas also worked on A Goofy Movie, which is celebrating its 30th anniversary this year!) - Klaudia A.

MyAnimeList To Be Sold to Web3 Startup Gaudiy (Anime Trending)

MyAnimeList is leaving the Kadokawa family after a few rough years in a row. Per SimilarWeb, the site gets ~30M monthly visits from 6.7M unique visitors. That’s a good amount of people, so what happened?

MAL’s typical user behavior looks more similar to a wiki or an encyclopedia than a social network, which puts it in an awkward middle ground for advertisers. It’s built up novel features, but most visitors don’t even track the anime they watch. Perhaps the Letterboxd subscription model is the way to go? - Miles A.

Ones to Watch

READ: Your Forma

Your Forma’s anime adaptation began airing in Japan and certain other regions, and comes to North America soon, but you should read the original award-winning light novel it’s based on, too! I read the first volume and instantly needed to get my hands on the rest. The intricacies and politics of Your Forma’s sci-fi world unfold through major crime investigations, led by an unlikely and incredibly charming duo, with the perfect blend of thriller and intrigue. - Chloe C.

WATCH: Umamusume: Cinderella Gray

Remember last week’s issue where we talked about the horse girl racing anime franchise? There’s a new Umamusume series out for the spring season called Umumusume: Cinderella Gray! It’s a great place to jump into the franchise if you’ve never tried it before. - Klaudia A.

Will Trump Use the Death Note on the U.S. Economy?

Yesterday morning, Trump’s global trade war was supposed to go into effect, imposing massive tariffs on economic friends and foes alike. The nebulous merits, contradictory motivations, and embarrassing mathematics at play here are all compelling topics for discussion, but for our purposes at Anime by the Numbers, let’s explore how the administration’s new import tax scheme impacts the anime and manga industries.

Note: As we were hitting publish on this piece yesterday, Trump announced a 90-day pause on all tariffs except for China. This will reduce the tariff on Japan from 26% to a temporary 10% blanket “reciprocal” tariff. As such, many of the implications of these trade actions are still relevant, but please consider this was written prior to these last-minute adjustments in U.S. trade policy.

Keep reading with a 7-day free trial

Subscribe to Anime By The Numbers to keep reading this post and get 7 days of free access to the full post archives.